Be Aware of Unclaimed Property Rules

Unclaimed property laws can be confusing and can create traps for the uninformed. Under Minnesota’s unclaimed property law, a business that fails to timely report and remit unclaimed property may be hit with severe penalties and interest. Consequently, businesses need to understand and comply with unclaimed property laws.

Unclaimed property laws can be confusing and can create traps for the uninformed. Under Minnesota’s unclaimed property law, a business that fails to timely report and remit unclaimed property may be hit with severe penalties and interest. Consequently, businesses need to understand and comply with unclaimed property laws.

Unclaimed property generally refers to abandoned intangible property. Common examples include dormant bank accounts, unclaimed wages, unpaid accounts payable, un-refunded overcharges, and deposits for the repair or purchase of goods or services. Under Minnesota law, however, unclaimed property does not include gift certificates, gift cards, or layaway accounts issued or maintained by a business selling tangible property or services at retail.

Common businesses that typically have unclaimed property include:

- Retailers

- Manufacturers

- Brokers

- Real estate agents

- Hospitals

- Clinics

- Oil and gas companies

- Financial institutions

- Insurance companies

The party responsible to report and forward unclaimed property to the state is known as the “holder.” Reporting requirements arise when the holder has held certain property for a specified period of time, called the dormancy period. Different dormancy periods exist for different types of property. For example, uncashed wage checks become unclaimed property after a one-year period, and customer overpayments become unclaimed property after a three-year period.

Determining the “holder”

Determining the holder can be confusing. Often, the holder is not the party with custody of the property. For example, many businesses outsource rebate programs to third parties, called fulfillment houses. Typically, these fulfillment houses are responsible for administering the rebate program on behalf of the business. The fulfillment house collects and processes the rebate claim and subsequently remits a rebate check to the consumer. If the consumer fails to cash the rebate check, the unused rebate becomes unclaimed property after the dormancy period expires. Unfortunately, businesses may think they are not the holder in these situations. Despite outsourcing the rebate program, the business may be responsible for remitting the unclaimed rebates to the state. The business will want to understand the applicable law to identify if it has any exposure in these situations.

Due diligence and filing requirements

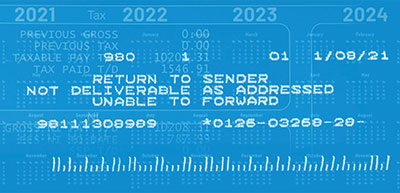

Holders must conduct due diligence in finding the rightful owner of property. Under Minnesota law, a holder must send written notice to the presumed owner within 120 days before filing a report if:

- The holder’s records contain an address for the presumed owner that the records do not disclose as inaccurate;

- The statute of limitations does not bar the presumed owner from bringing a claim; and

- The property has a value of $100 or more.

Holders with unclaimed property must report and forward, regardless of amount, unclaimed property to the Minnesota Department of Commerce. For property that becomes unclaimed property on June 30, most holders must report by November 1 of that same year, while life insurance companies must report by October 1.

A failure to report results in a misdemeanor. A willful refusal to pay or deliver unclaimed property results in a gross misdemeanor. Additional penalties and 12% interest may also be imposed.

Here are some tips for “holders”:

- Implement procedures to monitor the dormancy period of property held. Be aware that different dormancy periods exist for different types of property.

- Review record retention policies. Under Minnesota law, the statute of limitations is generally ten years after the filing of a report. Retain applicable documents, including copies of all filed reports and remittances, before the expiration of the statute of limitations. If a holder is unable to produce records, auditors may attempt to estimate past-due liability for years without records. The auditor’s use of estimation may create draconian results.

- Consider filing past reports to start running the statute of limitations. A failure to file a report allows the Department of Commerce to audit and impose penalties and interest for an indefinite period. The statute of limitations does not begin until a report is filed.

- If a third-party administers any consumer rebates (e.g., fulfillment houses), review contracts and records to determine which entity is responsible to report and remit unclaimed property to the state.

- If under audit, seek the advice of a professional knowledgeable in the area of unclaimed property. A knowledgeable professional will identify any applicable defenses that may help the holder avoid or reduce liability. The professional may also be able to achieve a favorable result through negotiation.

This article addresses Minnesota’s unclaimed property law. The laws of other states may differ. If you have any questions regarding how to handle unclaimed property, please reach out to your Moss & Barnett attorney.