Tax Planning Alert – International Tax Changes

On December 22, 2017, President Trump signed the Tax Cuts and Jobs Act into law, which makes a number of changes to the federal tax laws. The recently signed Tax Cuts and Jobs Act includes far-reaching changes for all United States taxpayers, including individuals, corporations, corporations with substantial international business, and small businesses.

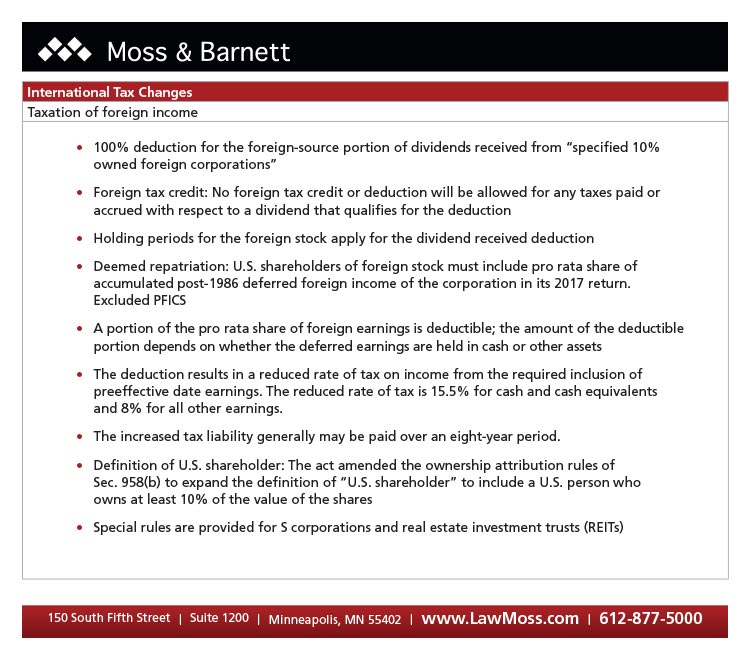

The Tax Cuts and Jobs Act radically changes the current worldwide taxation model of taxing foreign sources of income and replaces it with a modified territorial system.

In light of the changes to the tax laws, this is a good time to review your tax plan to determine whether changes are needed. Please note: The Tax Cuts and Jobs Act is over 1,000 pages long. We can provide only a short summary of a few highlights here. Other provisions of the Act may have a material impact on you.